Contact person: Shirley He

Contact person: Shirley He

Email: shirleyhe@ahbczn.com

Email: shirleyhe@ahbczn.com

WhatsApp: +86-18155182967

Mobile: +86-18155182967

WhatsApp: +86-18155182967

Mobile: +86-18155182967

Contact person: Shirley He

Contact person: Shirley He

Email: shirleyhe@ahbczn.com

Email: shirleyhe@ahbczn.com

WhatsApp: +86-18155182967

Mobile: +86-18155182967

WhatsApp: +86-18155182967

Mobile: +86-18155182967

CLASSIFICATION

CLASSIFICATION RECOMMENDED

RECOMMENDED

▼ Packing speed: 50-60 bags per minute

▼ Power: 0.8kw

▼ Accuracy: ±0.2%

▼ Weighing range: 20-1000g

▼ Save 3 workers at least

▼ Improve production efficiency

▼ Accuracy:±0.1- 0.2%

▼ Weighing range: 20-5000g

▼ Packing speed: 30-50bags/min

▼ Professional after-sale team

▼ Weighing range: 20-5000g

▼ Packing speed: 30-50bags/min

▼ Professional after-sale team

▼ 10 or 14 heads as per your requriement.

▼ Packing speed: 30-50 bags/min

▼ Accuracy: ±0.1- 0.2%

Background

China, the world's second-largest seed market, comes second only to the United States, consuming approximately 12 million tons of seeds annually, with a market value of $19 billion. The seed usage for the seven major crops (corn, rice, wheat, soybeans, cotton, potatoes, and rapeseed) amounts to around 10 million tons, with a market value of $13.5 billion. The commercialization rate of major crop seeds in China is about 70%, with the remaining seeds coming from farmer-saved seeds from the previous season. The market share of commercial seeds varies depending on the crop, with cotton having the highest market share at 88% and potato seed having the lowest at 40%. According to official reports, China has achieved self-sufficiency in rice and wheat seeds, while corn and soybean seeds are nearly self-sufficient. Despite continuous improvement in vegetable varieties domestically, 15% of China's vegetable seeds are still reliant on imports.

The "2022 China Crop Seed Industry Development Report" by the Ministry of Agriculture and Rural Affairs (referred to as the "2022 Seed Report") reveals various trends in seed usage. The use of corn seeds has slowed down, decreasing from 28.65 kg/ha in 2017 to 26.5 kg/ha in 2021, primarily due to the widespread adoption of precision planting technologies. Hybrid rice seed usage increased from 16.8 kg/ha in 2017 to 18.2 kg/ha in 2021, driven by the expansion of mechanized rice planting areas. Wheat seed yields increased from 187.4 kg/ha in 2017 to 214 kg/ha in 2021, primarily due to increased planting density.

According to the "2022 Seed Report," there were 7,668 seed companies holding valid business licenses as of the end of 2021. Among these, there were 1,920 companies engaged in the corn seed business, 1,182 in rice seed, 1,356 in wheat seed, 506 in soybean seed, 202 in cottonseed, 519 in rapeseed, 430 in potato seed, 312 in peanut seed, and 2,638 in melon seed (note: the total exceeds 7,668 due to some companies producing multiple types of seeds, such as both corn and soybean seeds).

Seed Market

In March 2023, the National Agricultural Technology Extension Service Center released the supply and demand data for major crop seeds for the 2023 crop year (October to September) at the 19th National Seed Information and Product Trading Fair. The main information is as follows:

Corn Due to the expansion of corn seed planting areas, the production of hybrid corn seeds for the 2022/23 crop year is estimated to be 1.36 million tons, an increase of 31% from the 2021/22 crop year. According to statistics from the Ministry of Agriculture and Rural Affairs, the planting area of hybrid corn seeds increased by 35% in the 2022/23 crop year, reaching 244,000 hectares, setting a new high in the past six years. The significant growth is mainly attributed to lower corn seed inventories. Despite adverse weather conditions affecting production in the northwest and southwest major producing regions, the average yield of hybrid corn seeds in 2022 was 5,580 kg/ha, at a median level over the past five years. Gansu Province remains the largest producer of corn seeds in China, accounting for approximately 48% of the total corn seed area in the 2022/23 crop year.

The total supply of corn seeds for the 2022/23 crop year in China is estimated at 1.65 million tons, with a carryover inventory of 290,000 tons. The estimated demand for hybrid corn seeds in the 2022/23 crop year is 1.15 million tons, resulting in an increase in inventories to 500,000 tons. The average national selling price for corn is expected to be CNY 35.4/kg, a 14% increase from the same period last year. However, industry insiders predict a significant price increase due to a 20% rise in production costs from the previous year.

Rice Due to expanded planting areas, the production of hybrid rice seeds for the 2022/23 crop year is estimated to be 280,000 tons, an increase of 5% from the 2021/22 crop year. Statistics from the Ministry of Agriculture and Rural Affairs indicate that the planting area of hybrid rice seeds increased by 25% in the 2022/23 crop year, reaching 131,000 hectares. Out of the total area, early-season rice occupies 16,100 hectares, mid-season rice occupies 84,000 hectares, and late-season rice occupies 31,000 hectares. Adverse weather conditions led to a decrease in the average yield of hybrid rice seeds in the 2022/23 crop year, down about 22% compared to the previous year.

The total supply of hybrid rice seeds for the 2022/23 crop year is estimated at 330,000 tons, with a demand estimate of 270,000 tons for domestic use and exports. The average selling price for hybrid rice seeds is projected to be CNY 78.44/kg.

Soybeans The production of soybean seeds for the 2022/23 crop year is estimated at 880,000 tons, representing a 17% increase from the 2021/22 crop year. China's soybean seed supply is ample and can meet domestic demand.

Trade

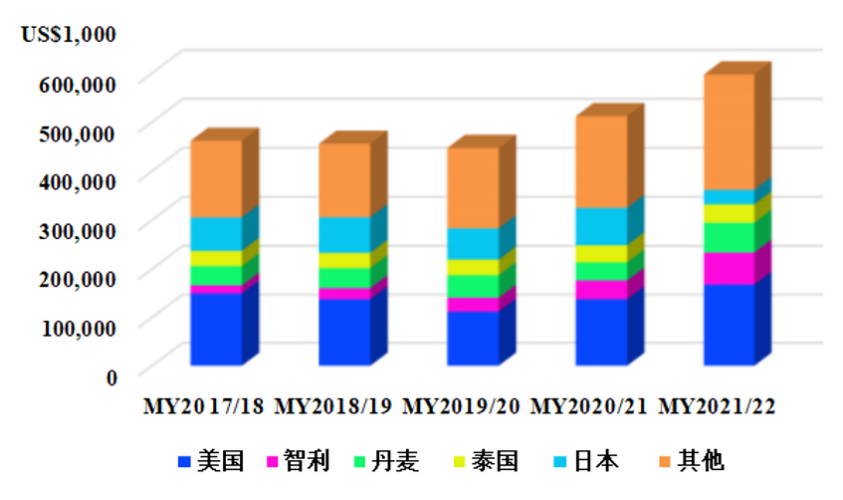

Due to reduced imports of forage seeds, which account for nearly 80% of China's total seed imports, it is expected that China's total seed imports for the 2022/23 crop year will decrease by 25% compared to the 2021/22 crop year. Major restrictions on market access for staple crop seeds such as corn, wheat, rice, and soybeans, along with China's goal of self-sufficiency in staple foods, have resulted in relatively fewer imports of major crop seeds. Vegetables and forage seeds are the top two categories of imported seeds, accounting for 78% and 80% of China's total seed imports by quantity and value, respectively. The United States remains China's largest seed supplier, accounting for 28% of China's seed imports in the 2020/21 crop year, followed by Chile (11%), Denmark (10%), Thailand (6%), and Japan (5%).

Import of Vegetable Seeds

Due to increased demand for premium and specialty vegetable seeds, China's vegetable seed imports are expected to reach 11,500 tons in the 2022/23 crop year, a growth of about 10% from the previous year. In addition, industry statistics indicate that China's vegetable planting area has maintained a growth rate of 1.5-2% in the past three years, which is expected to continue to meet the country's growing vegetable demand.

According to data from the Ministry of Agriculture and Rural Affairs, China's annual demand for vegetable seeds is around 100,000 tons, while imports in recent years have ranged from 90,000 to 105,000 tons, accounting for approximately 10% of the total demand.

China's vegetable seed companies are increasingly producing seeds overseas, especially in South America, where similar climates and counter-seasonal advantages are leveraged, followed by exporting the seeds back to China. China's major vegetable seed imports include tomato, broccoli, carrot, onion, and spinach seeds.

In terms of quantity, Italy, Thailand, Indonesia, and Denmark supplied about 90% of China's vegetable seed imports in the 2021/22 crop year. While the United States accounted for less than 1% of China's vegetable seed imports by quantity, due to higher unit prices, its import value represented 12% of China's total vegetable seed imports, trailing behind Chile at 2% but accounting for 23% of the import value. According to Chinese customs data, the import price for vegetable seeds from the United States was $173,984 per ton in the 2021/22 crop year, while the price from Chile was $314,022 per ton, with an average import price of $26,690 per ton for all importers.

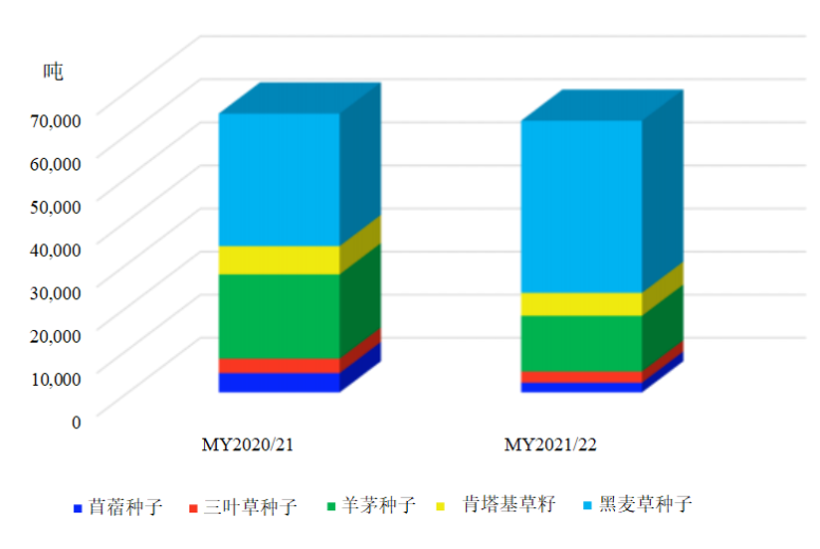

Import of Forage Seeds

Due to weak demand and high inventories domestically, the import of forage seeds for the 2022/23 crop year is expected to decline by 35% compared to the 2021/22 crop year. Despite soaring prices, China's import volume of forage seeds in the 2021/22 crop year did not decrease as anticipated. This was primarily due to a higher import volume of black oat seeds, which accounted for 63% of China's total forage seed imports. The import volume of black oat seeds increased by 30% in the 2021/22 crop year, but the average import price grew by 59% compared to the previous year. Notably, the price of black oat seeds imported from the United States increased by 80% due to reduced production.

Despite higher prices, concerns about supply shortages and expectations of strong sales in the 2020/21 crop year prompted importers to stockpile goods. High import volumes have translated into inventory, which will further reduce imports in the 2022/23 crop year. According to Chinese customs data, imports of forage seeds in the first five months of the 2022/23 crop year decreased by 65% compared to the same period in the 2021/22 crop year. Industry insiders predict that with a significant decrease in import volume, inventories are depleting, leading to an anticipated rebound in import volume in the latter half of the year.

In February 2022, the Ministry of Agriculture and Rural Affairs released the "14th Five-Year Plan for National Forage Industry Development." According to the plan, China's forage planting area was about 5.3 million hectares in 2020. Of this, silage corn accounted for 2.5 million hectares, while oat and black oat accounted for 670,000 hectares and alfalfa for 430,000 hectares. China's forage production is expected to increase from 71.6 million tons in 2020 to 98 million tons in 2025. While the plan aims to increase the overall self-sufficiency rate of forage seeds (including silage corn seeds) to 70% by 2025, the industry remains skeptical given China's limited ability in forage seed breeding, high production costs, and limited arable land.

Export

China's total seed exports for the 2022/23 crop year are expected to be 30,000 tons, a decrease of about 10% from the 2021/22 crop year. This decline is mainly attributed to a decrease in rice seed exports, which accounted for over 70% of China's total seed exports. In the 2021/22 crop year, rice seeds accounted for 76% of China's total seed exports by quantity, but only 34% by value. Meanwhile, vegetable seeds accounted for 12% of the total quantity but 46% by value.

The export volume of hybrid rice seeds for the 2022/23 crop year is estimated to be 22,000 tons, a decrease of about 12% from the 2021/22 crop year. According to industry experts, investment from Chinese rice seed companies and multinational seed companies in their respective countries may lead to reduced imports and increased local production of traditional rice seeds in importing countries. Pakistan, the Philippines, and Vietnam are the largest buyers of Chinese hybrid rice seeds, accounting for 97% of China's total hybrid rice seed exports in the 2021/22 crop year.

The export volume of vegetable seeds for the 2022/23 crop year is expected to remain steady at 3,900 tons, unchanged from the previous year. Insider reports suggest that most of the exported vegetable seeds are contracted by foreign companies (foreign enterprises commission Chinese manufacturers to produce specified seeds and then export them). Major exported vegetable seeds include tomato, lettuce, legume, and cabbage seeds.

The main buyers of China's exported vegetable seeds are Vietnam, the Netherlands, Italy, South Korea, and the United States, accounting for about 55% of China's total vegetable seed exports in the 2021/22 crop year.